Types of mutual funds in India in 2020

Types of mutual funds in India

As per AMFI India, there are more than 17000+ different mutual funds available to invest in India. As a retail investor, it often becomes challenging to understand the difference between different various types of mutual funds in India.

Types of mutual funds in India can be broadly categorized into 2 categories:-

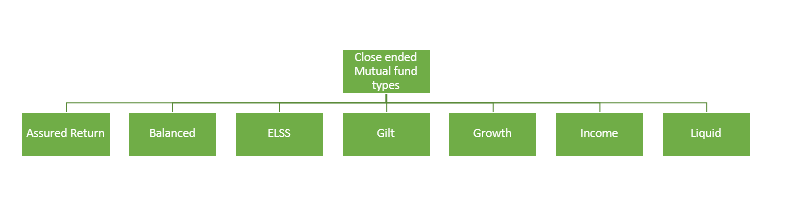

- Close ended mutual funds

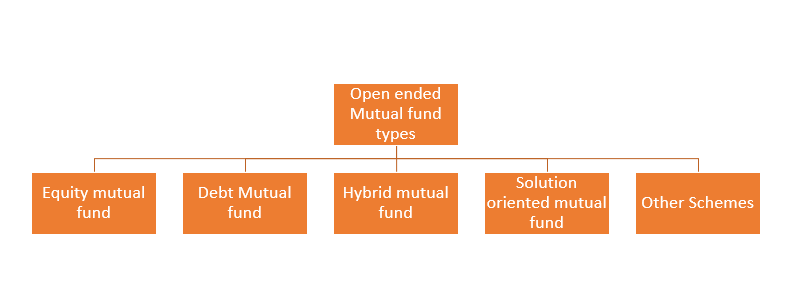

- Open ended mutual funds

Different types of close-ended mutual funds

Different types of open-ended mutual funds

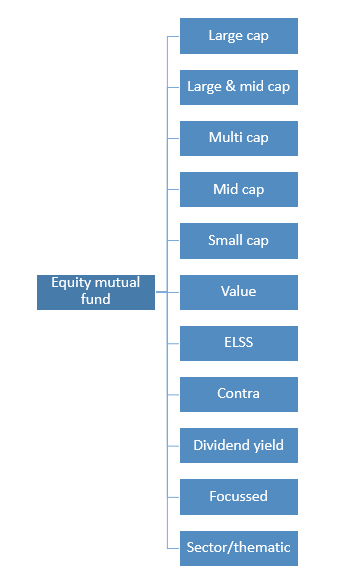

Different types of equity mutual funds

Equity mutual fund Categorization

On October 6 2017, SEBI came out with circular to categorize equity mutual funds based on below criteria:-

| Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

| Multi-Cap Fund | Minimum investment in equity & equity related instruments- 65% of total assets | Multi Cap Fund- An open ended equity scheme investing across large cap, mid cap, small cap stocks |

| Large Cap Fund | Minimum investment in equity & equity related instruments of large cap companies- 80% of total assets | Large Cap Fund- An open-ended equity scheme predominantly investing in large-cap stocks |

| Large & Mid Cap Fund | Minimum investment in equity & equity related instruments of large cap companies- 35% of total assets Minimum investment in equity & equity related instruments of mid cap stocks- 35% of total assets | Large & Mid Cap Fund- An open ended equity scheme investing in both large cap and mid cap stocks |

| Mid Cap Fund | Minimum investment in equity & equity related instruments of mid cap companies- 65% of total assets | Mid Cap Fund- An open ended equity scheme predominantly investing in mid cap stocks |

| Small-cap Fund | Minimum investment in equity & equity related instruments of small cap companies- 65% of total assets | Small Cap Fund- An open ended equity scheme predominantly investing in small cap stocks |

| Dividend Yield Fund | Scheme should predominantly invest in dividend yielding stocks. Minimum investment in equity- 65% of total assets | An open ended equity scheme predominantly investing in dividend yielding stocks |

| Value Fund* | Scheme should follow a value investment strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An open ended equity scheme following a value investment strategy |

| Contra Fund* | Scheme should follow a contrarian investment strategy. Minimum investment in equity & equity related instruments – 65% of total assets | An open ended equity scheme following contrarian investment strategy |

| Focused Fund | A scheme focused on the number of stocks (maximum 30) Minimum investment in equity & equity related instruments – 65% of total assets | An open ended equity scheme investing in maximum 30 stocks (mention where the scheme intends to focus, viz.,multi cap, large cap, mid cap, small cap) |

| Sectoral/ Thematic | Minimum investment in equity & equity related instruments of a particular sector/ particular theme- 80% of total assets | An open ended equity scheme investing in __ sector (mention the sector)/ An open ended equity scheme following __ theme (mention the theme) |

| ELSS | Minimum investment in equity & equity related instruments – 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance) | An open ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit |

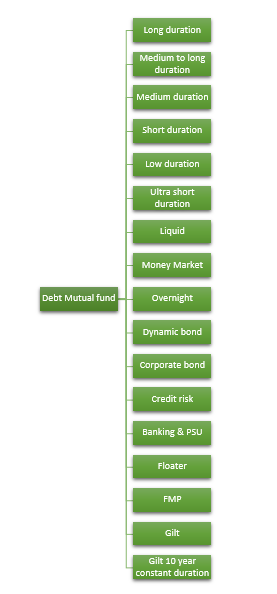

Different types of debt mutual funds

Debt mutual fund Categorization

On October 6 2017, SEBI came out with circular to categorize debt mutual funds based on below criteria:-

| Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of the scheme) |

| Overnight Fund | Investment in overnight securities having maturity of 1 day | An open ended debt scheme investing in overnight securities |

| Liquid Fund | Investment in Debt and money market securities with maturity of upto 91 days only | An open ended liquid scheme |

| Ultra Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 months – 6 months | An open ended ultra-short term debt scheme investing in instruments with Macaulay duration between 3 months and 6 months |

| Low Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 6 months- 12 months | An open ended low duration debt scheme investing in instruments with Macaulay duration between 6 months and 12 months |

| Money Market Fund | Investment in Money Market instruments having maturity upto 1 year | An open ended debt scheme investing in money market instruments |

| Short Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 1 year – 3 years | An open ended short term debt scheme investing in instruments with Macaulay duration between 1 year and 3 years |

| Medium Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 3 years – 4 years | An open ended medium term debt scheme investing in instruments with Macaulay duration between 3 years and 4 years |

| Medium to Long Duration Fund | Investment in Debt & Money Market instruments such that the Macaulay duration of the portfolio is between 4 – 7 years | An open ended medium term debt scheme investing in instruments with Macaulay duration between 4 years and 7 years |

| Long Duration Fund | Investment in Debt & Money Market Instruments such that the Macaulay duration of the portfolio is greater than 7 years | An open ended debt scheme investing in instruments with Macaulay duration greater than 7 years |

| Dynamic Bond | Investment across duration | An open ended dynamic debt scheme investing across duration |

| Corporate Bond Fund | Minimum investment in corporate bonds- 80% of total assets (only in highest rated instruments) | An open ended debt scheme predominantly investing in highest rated corporate bonds |

| Credit Risk Fund | Minimum investment in corporate bonds- 65% of total assets (investment in below highest rated instruments) | An open ended debt scheme investing in below highest rated corporate bonds |

| Banking and PSU Fund | Minimum investment in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions- 80% of total assets | An open ended debt scheme predominantly investing in Debt instruments of banks, Public Sector Undertakings, Public Financial Institutions |

| Gilt Fund | Minimum investment in Gsecs- 80% of total assets (across maturity) | An open ended debt scheme investing in government securities across maturity |

| Gilt Fund with 10 year constant duration | Minimum investment in Gsecs- 80% of total assets such that the Macaulay duration of the portfolio is equal to 10 years | An open ended debt scheme investing in government securities having a constant maturity of 10 years |

| Floater Fund | Minimum investment in floating rate instruments- 65% of total assets | An open ended debt scheme predominantly investing in floating rate instruments |

Different types of hybrid mutual funds

Hybrid mutual fund Categorization

On October 6 2017, SEBI came out with circular to categorize hybrid mutual funds based on below criteria:-

| Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of the scheme) |

| Conservative Hybrid Fund | Investment in equity & equity related instruments- between 10% and 25% of total assets; Investment in Debt instruments- between 75% and 90% of total assets | An open ended hybrid scheme investing predominantly in debt instruments |

| Balanced Hybrid Fund | Equity & Equity related instruments- between 40% and 60% of total assets; Debt instruments- between 40% and 60% of total assets No Arbitrage would be permitted in this scheme | An open ended balanced scheme investing in equity and debt instruments |

| Aggressive Hybrid Fund | Equity & Equity related instruments- between 65% and 80% of total assets; Debt instruments- between 20% 35% of total assets | An open ended hybrid scheme investing predominantly in equity and equity related instruments |

| Dynamic Asset Allocation or Balanced Advantage | Investment in equity/ debt that is managed dynamically | An open ended dynamic asset allocation fund |

| Multi-Asset Allocation | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes | An open-ended scheme investing in multiple asset classes |

| Arbitrage Fund | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments- 65% of total assets | An open ended scheme investing in arbitrage opportunities |

| Equity Savings | Minimum investment in equity & equity related instruments- 65% of total assets and minimum investment in debt- 10% of total assets Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document | An open ended scheme investing in equity, arbitrage and debt |

Different types of Solution-oriented mutual funds

Solution oriented mutual fund Categorization

On October 6 2017, SEBI came out with circular to categorize Solution-oriented mutual funds based on below criteria:-

| Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of the scheme) |

| Retirement Fund | Scheme having a lock-in for at least 5 years or till retirement age whichever is earlier | An open-ended retirement solution-oriented scheme having a lock-in of 5 years or till retirement age (whichever is earlier) |

| Children’s Fund | Scheme having a lock-in for at least 5 years or till the child attains age of majority whichever is earlier | An open ended fund for investment for children having a lock-in for at least 5 years or till the child attains age of majority (whichever is earlier) |

Different types of other mutual funds schemes

Other schemes mutual fund Categorization

| Category of Schemes | Scheme Characteristics | Type of scheme (uniform description of scheme) |

| Index Funds/ ETFs | The minimum investment in securities of a particular index (which is being replicated/ tracked)- 95% of total assets | An open ended scheme replicating/ tracking _ index |

| FoFs – Fund of funds (Overseas/ Domestic) | Minimum investment in the underlying fund- 95% of total assets | An open ended fund of fund scheme investing in other mutual funds. |

Types of mutual funds in India – how to select the right fund type?

Selecting the right mutual fund type can be a daunting task. You need to be careful while selecting a mutual fund to invest in. Before you start investing in a mutual fund ask yourself below questions:-

- The time period of investment

- willingness to take risk

- Liquidity requirements

It’s often seen that many close-ended mutual funds are sold with higher returns promise to investors. The investor doesn’t realize the terms and conditions of the fund and ends up losing the entire capital.

So when you invest in any type of mutual fund in India, always ask yourself- which type of mutual fund investment you are doing? what is the risk involved in that?

What are the risk involved in different types of mutual funds?

There is always risk involved in any investment you do. In mutual funds depending on the type of fund you invest the risk varies.

Equity mutual funds carry the highest risk as your money is invested into stocks. If the stock market does well then you get excellent returns but when the stock market falls then you lose money.

Hybrid mutual funds carry less risk compared to equity funds but they have some element of risk as they invest in mix of both equity and debt.

Debt mutual funds have less risk as compared to equity and hybrid mutual funds as they invest money in debt instruments which are relatively safe than equity mutual funds. But recently it’s seen that the debt mutual funds have started giving huge negative returns depending on the fund you have to invest in. So be careful while selecting a debt mutual fund. Read more about – Are debt funds safe?

Types of mutual funds in India – How to select a mutual fund?

Before you select a mutual fund to invest in. You must evaluate the fund. Here are the 5 factors you must consider before selecting a fund:-

- What is the Long Term Record of the Mutual fund?

- Who is the Fund Manager for the mutual fund?

- What is the track record of the AUM for the Fund?

- What is the Risk vs Return Record for the fund?

- What is the TER for the Fund?

Types of mutual funds in India – FAQs

What are the different types of mutual funds in India?

The main types of mutual funds are

Equity mutual fund

Debt Mutual fund

Hybrid mutual fund

Solution-oriented mutual fund

Other Schemes

What are the different kinds of equity funds?

Different type of equity mutual funds are

Large cap

Large & mid cap

Multi cap

Mid cap

Small cap

Value

ELSS

Contra

Dividend yield

Focussed

Sector/thematic

What is the safest mutual fund?

Debt mutual funds investing in Govt bonds are considered as safest mutual funds. Also Overnight funds and Liquid funds are considered as relatively safe compared with other types of mutual funds.

Which mutual fund is best for beginners?

For beginners with a long term investment view below mutual funds types are best

Large cap mutual fund

Multi cap mutual fund

Index funds

What is Blue Chip Fund?

A blue chip fund is a mutual fund which invested its money blue chip companies typically large cap companies.

What are the different types of debt mutual funds?

There are 17 types of debt mutual funds in India and they are:-

Long duration

Medium to long duration

Medium duration

Short duration

Low duration

Ultra short duration

Liquid

Money Market

Overnight

Dynamic bond

Corporate bond

Credit risk

Banking & PSU

Floater

FMP

Gilt

Gilt 10 year constant duration

Comments

Post a Comment